How gold acts as medium of transaction?

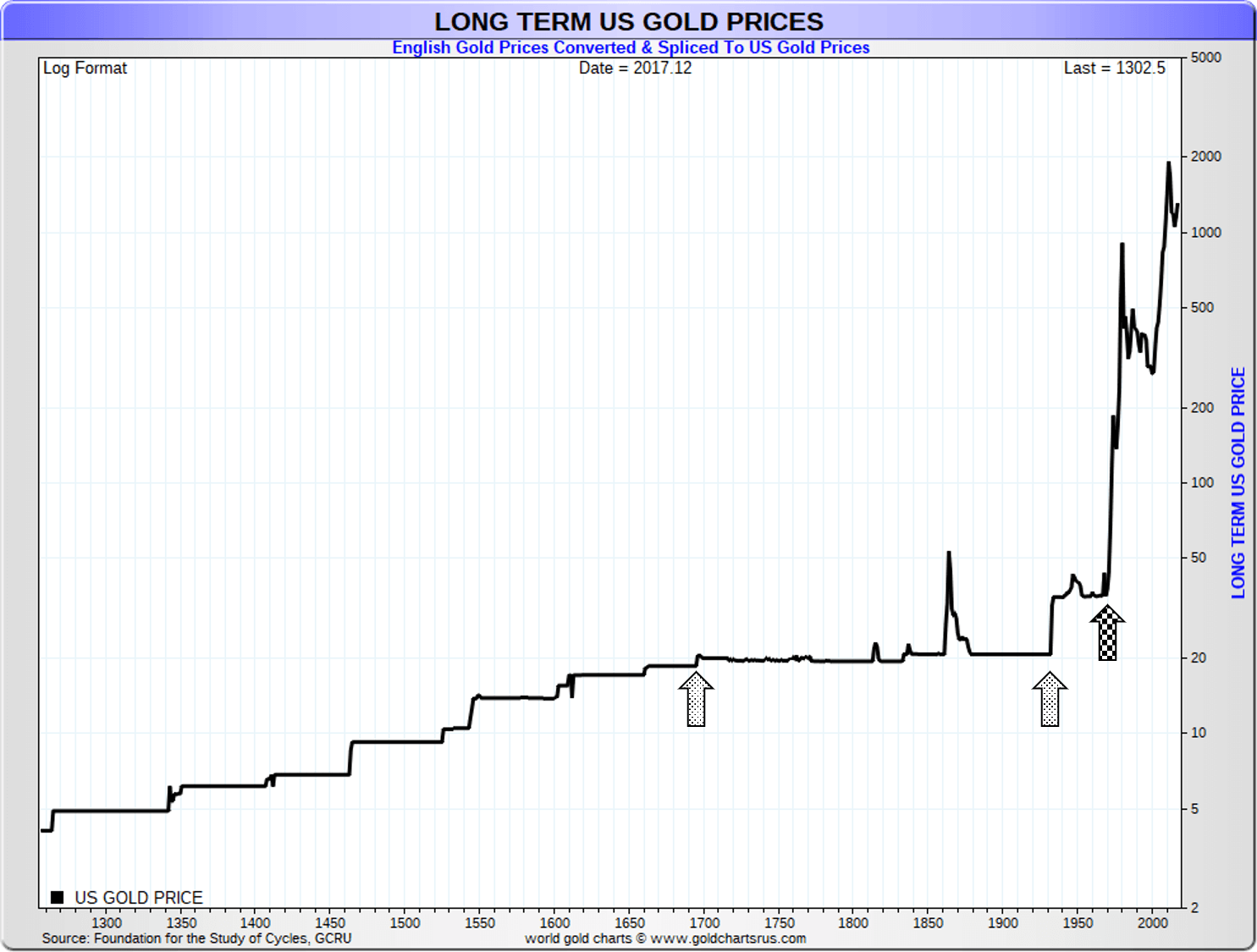

If the fiat money that we use today is pegged with a gold standard like the times before 1971, there would not be a ‘gold investment’. Based on the global gold price chart shown below, it is evident that before 1971, the price was somewhat stagnant for over 150 years (dotted arrows). Once the announcement was made in 1971, the gold price began to shoot up (checkered arrow).

Now that the fiat money is no longer pegged with a gold standard, numerous sources indicate the presence of ‘conspiracy’ in this regard. We cannot change the global financial system, but we can amend our financial system.

The conspiracy behind fiat money

Knowing how rampant the fiat money was utilized over these years, one way to revert to its previous position as a transaction medium is by increasing our holdings of gold. Meaning, we can consider converting our savings into gold instead of fiat money.

As the awareness regarding gold savings increases, we are in a position to utilize gold as an alternative money. Purchasing goods and services can be performed with gold while selling goods and services can be completed by receiving gold.

Gold as the real money

Since gold can be a better store of value and retains the purchasing power over the years, there is no risk of devaluation. To further support the strength of our fiat money, authorities have to guarantee its value to build trust amongst the citizens. My question is, can the ‘imposed’ trust be compromised?

Yes, indeed!

Gold is a standalone asset that does not require a guarantee from authorities or entities. Their values are dictated essentially through their weight and purity. Furthermore, gold has no expiry dates, unlike what we observe with fiat money. Gold can be kept for centuries and still be valuable for many more centuries to come. There are no boundary restrictions as everyone around the globe accepts gold as a valuable asset.

The return of gold as money

The initiatives on utilizing gold as money are not widely available. However, certain parties are willing to accept gold to facilitate business transactions. One of them is Public Gold, the largest gold and silver provider in Malaysia. They have launched an e-commerce platform known as PG Mall. The payment source to complete transactions can be derived from gold savings under the same provider. This is indeed a decent start to ‘revive’ the original function of gold as money.

If you find this article useful, consider sharing this with your friends and family. Let's create awareness about our money because nobody will come forward to help us.

Easy way to start gold savings can be found here: Gold Accumulation Program

Join my Facebook page for free here: FB page

Hope you find it useful.

Your buddy on gold investing,

Naresh G